- Executive summary

- Banks in Ghana face significant challenges from their high levels of Non-Performing Loans (NPL)

There is an issue plaguing the banking sector which is slowly killing the economy of the country. Yes, I am talking about uncontrolled lending. It seems like the banks have lent relentlessly and this is causing them to accumulate a lot of Non-Performing Loans (NPLs).

Loans are considered to be non-performing when they are equal to or greater than 90 days in arrears or where management believes a loss may be incurred.

Ghana is right now in a dire need to revive private investment. In face of such a crisis, when the country has GH¢7.96 billion stressed assets at the end of end of June 2017, things are definitely serious.

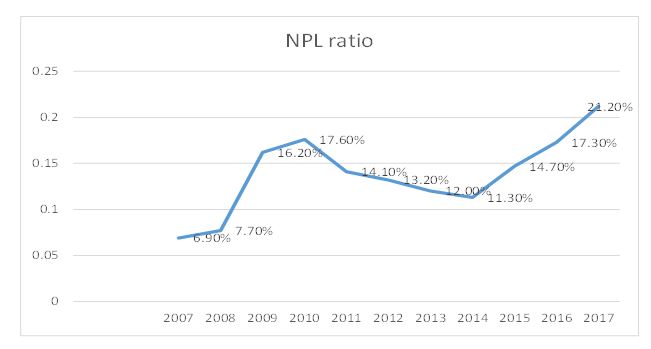

The ratio of NPLs to total gross loans (NPL ratio) experienced an increasing trend between 2007 and 2010 from 6.37 per cent to 18.08 per cent and declined to 11.27 per cent in 2014 and thereafter increased to 17.70 per cent in 2016 and 21.2 percent in June 2017.

- Persistently high NPLs hold down credit growth and economic activity

High NPL ratios in Ghana have considerable and wide-ranging impacts; for both banks and society at large.

For banks, NPLs tie up part of their capital base without providing a commensurate return, reducing profitability and increasing capital requirements (NPLs have a ‘risk weight’ of 150 percent under the Basel 3 Standardized Method).

For Ghanaian society, a banking system which is not firing on all cylinders, due to the drag of NPLs, does not have the capacity to drive net new lending (in particular to SMEs). This constrains economic growth and disrupts the functioning of the monetary policy transmission mechanism (from the central bank to real-economy borrowers).

- Accelerating the resolution of NPL in Ghana requires a comprehensive approach based on three key pillars:

Enhanced prudential oversight (“touch love”).

Despite the Asset Quality Review launched in 2016, little has been achieved in resolving the underlying assets to which banks had lent because most of the assets still suffer from very high levels of bank debt. Similar to Viral Acharya (Deputy Governor of Reserve Bank of India), I am proposing a “tough love” style approach towards the banks from now onwards. This is because this “tough love” measures will work towards the benefit of the banks but since the banks have been reckless towards lending in the past, such “tough love” measures will include the Bank of Ghana taking up the role of the parent that will put some additional regulations such as mandatory write off and time-bound restructuring targets on banks’ NPL portfolios. In addition, Bank of Ghana should enforce the following provision under the Specialised Deposit-Taking Institutions (SDIs) Act, 2016 (Act 930) with no mercy:

- Banks with NPLs above a set threshold (for example, 10 percent) should be subject to a more intensive oversight regime to ensure that they conservatively recognize and proactively address asset quality problems.

- Bank of Ghana exercising its powers under Section 93 of the Act to require Banks to submit accurate information to credit bureaus and applying the penalty for the submission of inaccurate, incomplete, delayed and non-submitted information to credit bureaus.

- Enforcing conservative provisioning and write off guidance under International Financial Reporting Standards (IFRS) 9- Section 78

- Conservative application of accounting standards should be supplemented by micro- and macro prudential measures, such as time-bound targets for resolving delinquent assets and raising risk weights on impaired assets of a certain vintage (above the current 150 percent, under the “standardized approach” adopted by all Banks in Ghana).

- As permitted by section 78 (1) (b)l, the Bank of Ghana applying the Basel Committee on Banking Supervision publication 155- Principles for sound stress testing practices and supervision[1] to require all Banks to perform stress testing as part of Internal Capital Adequacy Assessment Process (ICAAP) at least on a quarterly basis and for those Banks that fails the stress testing, Bank of Ghana will then exercise the following rights under Act 930 with no mercy:

- Exercise the right to require some Banks to maintain additional capital to address concentration of risks (Banks with high NPLs is an example). Section 30

- Exercise the right to increase to prescribe one or more capital buffers above that required by the minimum capital adequacy ratio for Banks with high NPLs. Section 29 (6)

- Exercise the right to prescribe leverage or gearing ratio for Banks with high NPLs. Section 29 (7)

- Submission of capital and liquidity restoration plans within 45 days of BoG’s requesting for Banks with capital and liquidity adequacy breaches The institution has 180 days from submission to conclude the capital and liquidity restoration process – Section 105(2b)

- BoG imposes restriction on growth of assets or liabilities – Section 105 (5a)(5b)(5c)

- If the problem persists after the first attempt BoG will provide a 90 day window for a new plan and a further 180 days to correct – Section 106 (1a) (1b)

- where the initial 2 attempts fail, BoG will place the institution into official administration – Sections 107-122 and

- Section 123 event where BoG revoke Banking license when they believe the institution will be insolvent within 60 days

For defaulters, some of the “tough love” measures I will recommend include

- Educating Borrowers on their rights under the Bank of Ghana guideline called “Disclosure and Product Transparency Rules for Credit Products and Services” issued in pursuance of Section 7 of the Borrowers and Lenders Act, 2008 (Act 773).

- Bank of Ghana publishing the list of “willful defaulters” responsible for the preponderance of problematic loans.

- Banks and Bank of Ghana publish personal details and photographs of willful defaulters and their guarantors.

- Bank of Ghana overseeing some of “willful defaulters” cases and directly pressure borrowers into repaying their loans.

b. Reforms to enhance debt enforcement regimes and insolvency frameworks. Effective out-of-court restructuring frameworks and improved access to debtor information should be encouraged.

- The provisions of the Companies Act, 1963 (Act 179), the Bodies Corporate (Official Liquidations) Act, 1963 (Act 180), or any other enactment relating to corporate insolvency or liquidation should be enhanced to include : (1) expedient in-court approval of settlements negotiated out of court ; (2) post-commencement financing recognizing creditor priority to enable financing for the firm during restructuring (3) inclusive restructuring involving all creditors (including secured and public creditors) (4) pre-insolvency processes that enable restructuring before reaching nonviability; (6) simplified and cost-effective insolvency processes for SMEs enabling a fresh start for entrepreneurs within a reasonable time period and (7) the facilitation of various restructuring tools, such as debt-equity swaps (for example, through removing the requirement for shareholders to approve corporate changes).

- Fixing the loopholes in the Borrowers and Lenders Act that encourages some borrowers to sue banks on some issue such as contesting the quantum of the loan amount indicated in the demand letter and making possession of collateral difficult.

- In addition to above, authorities and Bank of Ghana should streamline the perfection of collaterals. Currently, Bank of Ghana guidelines[2] stipulates that a collateral perfected should meet all these requirements:

- Assuming the collateral is a legal mortgage, the collateral title has been obtained in accordance with the Land Title Registration Act 1986 (PNDCL 152). On the other hand if the collateral is an equitable mortgages the mortgage interest has been obtained and there is evidence that the borrower has executed (ie, assigned) the mortgage to the lender (bank);

- The mortgage interest has been obtained Land commission and

- The charge is registered with BoG Collateral registry in accordance with the Lenders and Borrowers Act, 2007 (Act 773)

One issue I see with the above guidance is the possibility of duplication of registration and disjointed records that emanates with the absence of harmonization between the Collateral Registry and other registries such as the Company’s Registry, the Lands Commission and the Driver and Vehicle Licensing Authority (DVLA). Accordingly, authorities should consider to centralize Collateral registry with land tile and other registration so you have one spot for perfection of collateral.

c. Development of distressed debt markets by improving market infrastructure and, in some cases, using asset management companies (AMCs) to jump-start the market.

- How serious is the NPL Problem in Ghana?

a.Trends of NPL in Ghana

Source: Bank of Ghana Financial Stability Reports and Banking sector Reports

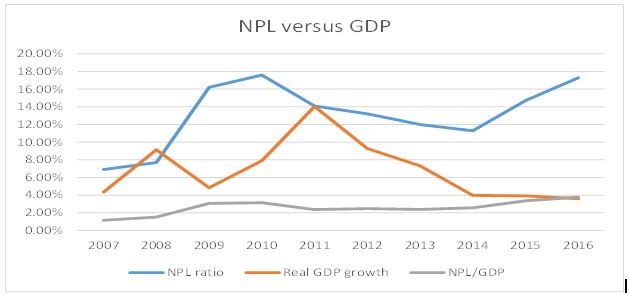

The graph below shows that NPL as a ratio of GDP is on the rise.

Despite the passage of Borrowers and Lenders Act, 2008 (Act 773) [3] and the Credit Reporting Act, 2007 (Act 726) which resulted in the establishment of credit reference bureaus and collateral registry, NPL continue to grow.

The stock of NPLs stood at GH¢6.2 billion as at end-December 2016, expanding at a compound annual growth rate (CAGR) of 41.89 per cent from GH¢0.26 billion by end-December 2007. By the end of June 2017, the stock of NPLs in the banking industry had risen to GH¢7.96 billion from GH¢6.09 billion in June 2016. The ratio of NPLs to total gross loans (NPL ratio) experienced an increasing trend between 2007 and 2010 from 6.37 per cent to 18.08 per cent and declined to 11.27 per cent in 2014 and thereafter increased to 17.70 per cent in 2016 and 21.2 percent in June 2017. The NPL ratio reduction from 2011 to 2014 was due mainly to an upsurge in new loans disbursed (i.e. increase in gross new loans) and not because of a reduction in the stock of NPLs.

Although in Ghana, the Borrowers and Lender Act 2008, Act 773, allows banks and other financial institutions to takeover collateral used in securitizing loans without going through the rigors of court, several loopholes have seen debtors’ slow banks down in taking over properties or securities. The authority from the Collateral Registry to grant a lender a lender to take over the property presupposes two things:

- The quantum of debt will not be contested

- Can take possession of the property in a peaceable manner.

The trick adopted by some borrowers is to sue the bank on some issue e.g. contest the quantum of the loan amount indicated in the demand letter. There can be no attachment or sale before the legal issues are decided by the courts.

Secondly, most mortgagors (especially if it’s a third party’s property) will go all out to make the takeover of the property difficult. Most banks to my knowledge take the safest route via the courts (section 33 (a) of Act 773[4])

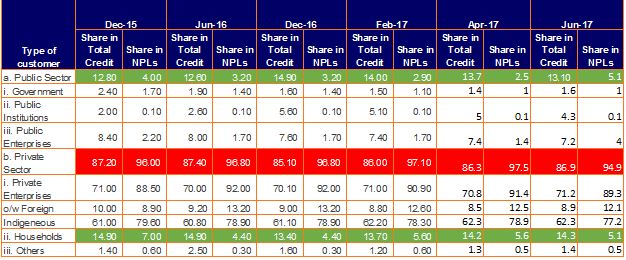

b. The Distribution of Credit & NPLs by customer type is below

Source: Bank of Ghana Financial Stability Reports and Banking sector Reports

The private sector, being the largest recipient of outstanding credit balances also accounted for the greatest proportion of banks’ NPLs. The share of private sector NPLs to total NPLs increased from 87.3 percent in June 2016 to 94.9 percent in June 2017 while the proportion of banks’ NPLs attributable to the public sector declined from 12.7 percent to 5.1 percent over the same period. The restructuring of the TOR and VRA debts accounted for the decline in the public sector’s share of NPLs during the review period. Most private sector non-performing loans were debts of indigenous enterprises accounting for 77.2 percent of total NPLs in June 2017.

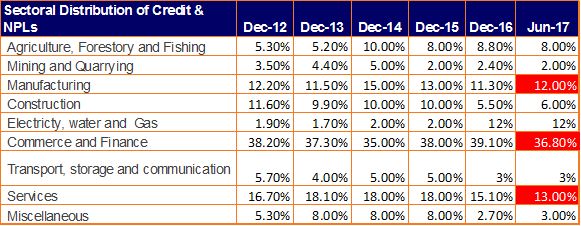

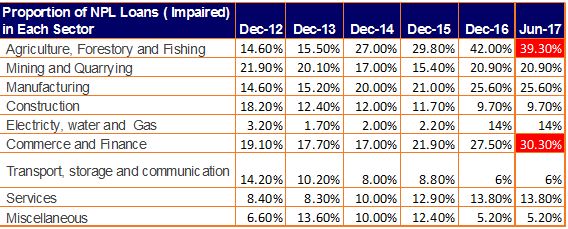

c. The sectoral Distribution of Credit & NPLs is below

Source: Bank of Ghana Financial Stability Reports and Banking sector Reports

The three largest sectors in terms of outstanding credit balances, namely are: the Commerce & Finance sector, the Services and the Electricity sector and the Gas & Water sector, which together accounted for 63.6 percent of total NPLs in June 2017.

d. The proportion of NPL Loans ( Impaired) in Each Sector

Source: Bank of Ghana Financial Stability Reports and Banking sector Reports

The Agriculture, Forestry & Fishing sector was however the sector with the highest proportion of its loans (39.3 percent) being classified as non-performing as at end-June 2017. It was followed closely by the Commerce & Finance Sector with a sectoral NPL ratio of 30.3 percent.

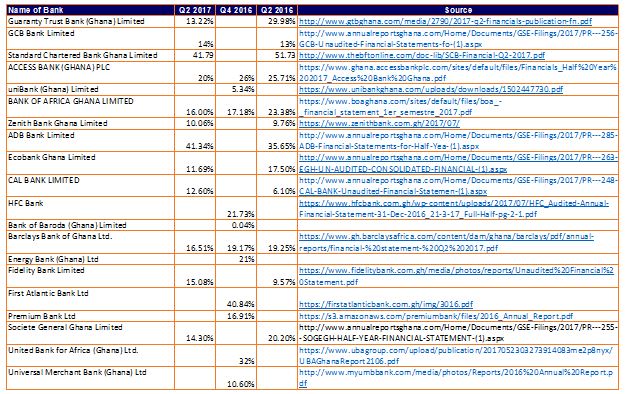

e. NPL ratio among Banks in Ghana

The focus of the analysis was to show Q2 2017 versus Q2 2016. For Banks that do have interim 2017 financial statements available on the internet, their Q4 2016 NPL ratios are shown instead.

The 2016 full year & 2017 half yearly financial statements for the following banks were not available on line to be used for the analysis : GN Bank Limited, National Investment Bank Ltd, Prudential Bank Limited, Stanbic Bank Ghana Ltd and The Beige Bank Limited. The following Banks were new and therefore have insignificant NPL ratios: The Royal Bank Limited, Heritage Bank Limited, The Construction Bank (Gh.) Limited, First National Bank Ghana Ltd.

If one bank displays a higher level of non-performing assets than another bank during a year, this does not necessarily mean that the first bank experienced a higher level of credit losses during the year. This may be because the first bank’s non-performing assets were highly collateralized than other types of lending. Alternatively, the second bank may simply have written off its non-performing assets more quickly than the first bank, in an attempt to display a healthier loan book to investors and ratings agencies.

In some countries, public-sector banks are more exposed to NPLs than Private-sector Banks because public-sector banks’ portfolios tend to lean toward infrastructure, real estate and telecom, which become significantly hampered during economic downturns. As well, in these countries, private-sector banks are considered to be more vigilant and prudent in their credit appraisal, risk management and loan recovery practices. This trend is however not exhibited among Banks in Ghana since both private and public-sector Banks exhibit high NPL. Suffice to say the Bank with the highest NPL at the end of Q2 2017 was Standard Chartered Bank Ghana Limited, a private sector Bank.

- What Are The Macro-Financial Implications Of High NPL?

- NPL and Bank Lending

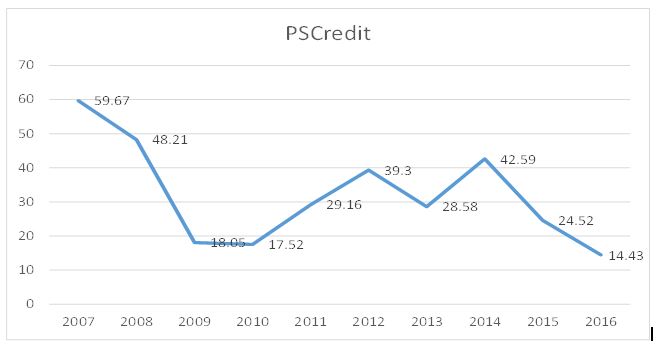

- NPLs influence bank lending through three interrelated key channels—profitability, Capital, and funding. Bank profitability suffers because high NPLs require banks to increase provisions, which lowers net income, while NPLs carried on banks’ books do not usually generate income streams comparable to performing assets. NPLs, net of provisions, may also tie up substantial amounts of capital due to higher risk weights on impaired assets. Also a deteriorating balance sheet raises a bank’s funding costs because of lower expected revenue streams and, hence, heightened risk perceptions on the part of investors. Together, these factors result in a combination of higher lending rates, reduced lending volumes, and increased risk aversion. See below a graph of Private Sector Credit (y-o-y) Growth(%) obtained from Bank of Ghana monetary times series data section of its website (https://www.bog.gov.gh/statistics/time-series-data)

- Banks that have weaker balance sheets tend to lend less. Data for Banks in Ghana from Bank of Ghana banking sector report confirm that banks with higher NPLs tend to be less profitable, have relatively weaker capital buffers, and face higher funding costs. They also tend to lend less. A growing amount of literature on the macro-financial effects of NPLs is pointing out a robust relationship between higher NPLs and weaker credit and GDP growth, with causality going both ways. Banks’ reduced lending capacity undermines the growth prospects of viable firms, and it is also likely to disproportionately affect SMEs that are more dependent on bank financing. This is of particular concern because SMEs account for significant shares of total output and employment

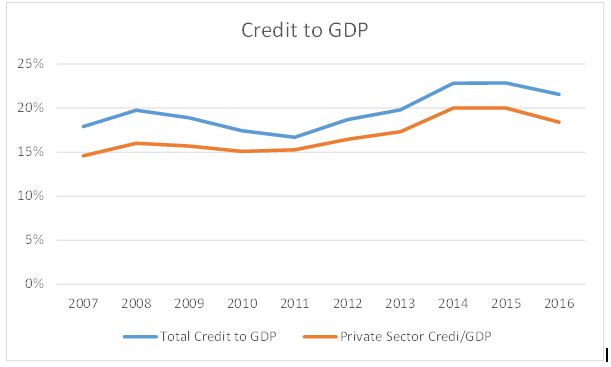

- The impact of NPL on GDP growth

Using different country samples, all recent studies find that higher NPLs tend to reduce the credit-to-GDP ratio and GDP growth, while increasing unemployment. This is consistent with the data from Bank of Ghana Financial Stability Reports and Banking sector Reports and Ghana statistical service.

- What are the obstacles to NPL resolution?

a.Prudential supervision

- Write-off practices- Banks are required to seek Bank of Ghana approval before writing off loans, this creates an incentive for Banks not to write off loans.

- Weak capital buffers and difficulties in realizing collateral increase banks’ reluctance to address NPLs. Low profitability and thin capital buffers constrain banks’ ability to increase provisions and discourage the timely recognition of credit losses. The high level of NPLs relative to banks’ going concern loss absorbing capacity (that is, common equity plus reserves) also constrains banks’ ability to accept further credit losses.

- According to the IMF survey, collateral-related issues are a greater concern than capital buffers. While bank capital buffers are deemed a medium concern in about half the countries surveyed, collateral-related issues elicit either medium or high concern in most of them. These rankings partly reflect thin real estate markets (as the most common type of collateral is real estate) and difficulties in estimating collateral recovery values given weak debt enforcement frameworks. With only a few exceptions, collateral valuations are reportedly based on market prices, although in many countries, deep and liquid markets for foreclosed properties are lacking.

- According to the IMF survey, more than half of surveyed countries have some concerns about banks’ capacity for NPL management, even though most banks tend to have dedicated NPL resolution units.

b. Legal Obstacles

- Although in Ghana, the Borrowers and Lender Act 2008, Act 773, allows banks and other financial institutions to takeover collateral used in securitizing loans without going through the rigors of court, several loopholes have seen debtors’ slow banks down in taking over properties or securities.

- The efficiency of the institutional framework (particularly judicial systems) matters as well.

c. No secondary market for distressed debts in Ghana

- Developing a liquid market for NPLs is crucial to provide an outlet for banks to dispose of their distressed assets and to boost recovery values.

d. Informational obstacles

- Incomplete information can impede effective recovery of distressed debt. The IMF survey collected assessments of (1) public registers, (2) debt counseling services and citizen awareness, (3) quality of information reported by banks to supervisors, and (4) constraints on information sharing among creditors.

- Information deficiencies or constraints on information sharing are fairly common. The general public is unable to conduct searches in public asset registers (in about one-third of surveyed countries) and real estate transaction registers (in about half of the sample). Also restrictions on sharing individual debtor’s information for debt recovery purposes are widespread. Furthermore, credit bureaus typically do not include certain types of information relevant for debt restructuring, that is, on tax payments and social security contributions (about 80 percent of surveyed countries) and payments to utility companies (two-thirds of surveyed countries). Credit registers in more than half the sample do not have credit scoring for individuals, and about half do not produce credit scores for SMEs and larger companies.

e. Lack of debt counseling is another common problem

- A comprehensive NPL Resolution strategy

International experience prior to the global financial crisis as well as recent European experience suggests that a comprehensive strategy is most effective in resolving NPLs (Hagan and others 2003; Liu and Rosenberg 2013). Such a strategy typically includes three crucial elements:

(1) Tightened supervisory policies,

(2) Insolvency reforms, and

(3) The development of a distressed debt market.

a.Supervisory policies

– Pursue a conservative application of accounting standards for impaired asset In particular, a supervisory policy should be introduced that underscores the importance of timely uncollectible loan write-offs before having exhausted all legal means to collect the debt. Time-bound write-off requirements for uncollectible loans could also be considered within the confines of Act 930. With regard to interest accrual practices, the adoption, for prudential purposes, of a nonaccrual principle for loans past a set delinquency threshold would be critical.

– Ensure that banks apply a conservative approach to collateral valuation. While it is reasonable to take account of collateral in provisioning, a conservative approach should be adopted, reflecting various constraints in valuing, accessing, and disposing of collateral. In particular, the value of collateral should reflect changes in market conditions, the costs of sale, and delays in realizing proceeds etc. Furthermore, collateral should be periodically valued by reliable and independent third parties and subject to enhanced supervisory scrutiny. In the case of real estate, banks should obtain

sound appraisals of the current fair value of the collateral from qualified professionals.

- Strengthen capital requirements to encourage asset disposal. Conservative application of accounting standards should be supplemented by micro- and macro prudential measures, such as time-bound targets for resolving delinquent assets and raising risk weights on impaired assets of a certain vintage (above the current 150 percent, for instance, for banks reporting under the “standardized approach”). In some cases, the combination of realistic provisioning, conservative collateral valuation, and stronger valuation may reveal that certain banks are insolvent, in which case regulators should encourage these banks to exit the market.

- Enhance prudential oversight- Banks with NPLs above a set threshold (for example, 10 percent) should be subject to a more intensive oversight regime to ensure that they conservatively recognize and proactively address asset quality problems. Prudential reporting requirements for NPL portfolios should be significantly enhanced through detailed submissions (on a quarterly or more frequent basis). For banks with high NPLs, BoG could agree with banks on operational targets for NPL resolution and introduce standardized criteria for identifying nonviable firms for quick liquidation and viable ones for restructuring.

- Require banks to develop internal NPL management capabilities. Banks should be encouraged to develop a comprehensive NPL management plan, which determines rules and work practices for NPL resolution, such as (1) removing impaired loans from regular loan servicing and adopting specific tools for early arrears, (2) conducting risk scoring to set case prioritization, and (3) developing a customer charter to cater for hardship and sensitive cases, subject to clearly defined implementation targets.

- Enhance disclosure. Extended Pillar III reporting of NPLs and granular disclosure by supervisory authorities of NPL portfolios and NPL management performance would increase market transparency and discipline. Disclosures could usefully include the accrual treatment for NPLs.

- Insolvency and debt enforcement reforms[5]

- Strengthen incentives for viable but distressed debtors and creditors to participate in meaningful restructuring. The legal framework should consist of both legal tools designed to facilitate speedy in- and out-of-court solutions and an adequate institutional framework (including courts and insolvency practitioners) to support the consistent, efficient, and predictable implementation of the laws. More specially, authorities should:

- Enable the rapid exit of nonviable firms and the rehabilitation of viable firms. The provisions of the Companies Act, 1963 (Act 179), the Bodies Corporate (Official Liquidations) Act, 1963 (Act 180), or any other enactment relating to corporate insolvency or liquidation should be enhanced to include : (1) expedient in-court approval of settlements negotiated out of court ; (2) post-commencement financing recognizing creditor priority to enable financing for the firm during restructuring (3) inclusive restructuring involving all creditors (including secured and public creditors) (4) pre-insolvency processes that enable restructuring before reaching nonviability; (6) simplified and cost-effective insolvency processes for SMEs enabling a fresh start for entrepreneurs within a reasonable time period and (7) the facilitation of various restructuring tools, such as debt-equity swaps (for example, through removing the requirement for shareholders to approve corporate changes)

ii.Augment out-of-court frameworks with hybrid features. International practice suggests that out of- court debt restructuring generates more rapid and cost-effective results, especially if the restructuring occurs against the backdrop of strong insolvency procedures. Out-of-court frameworks that use hybrid and enhanced features, such as a stay on creditor actions, majority voting, mediation or arbitration, or a coordinating committee, achieve the best results.

iii. Strengthen debt enforcement and foreclosure processes. Enforcement and foreclosure processes should be simplified and streamlined (for example, to clearly specify enforceable titles, limit appeals, set short preclusive deadlines) to enable a swift process. Out-of-court enforcement and foreclosure should be considered where appropriate.

- Improve the institutional framework. The judicial system should be strengthened by increasing the specialization of judges and establishing special benches for commercial or insolvency matters. The performance of professionals (such as insolvency practitioners or bailiffs) should be properly supervised and adequately monitored. The fee structure should incentivize the rapid return to the productive value of business assets and be performance based.

c. External NPL management and distressed debt markets

- Foster the development of markets for distressed assets to facilitate the disposal of NPLs, recognizing market infrastructure as a crucial constraint Access to timely financial information on distressed borrowers, collateral valuations, and recent NPL sales are critical for the development of an active market for NPL restructuring. Facilitating the licensing of nonbanks for restructuring, as opposed to entities with a banking license, would lower the cost of entry into this market and allow for greater specialization. Use of specialist NPL servicing and legal workout agencies, and more efficient collateral auctions would help raise recovery values

- Asset management companies (AMCs[6]) or other special-purpose vehicles could help kick-start a market for distressed debt. First, they bring economies of scale, which may help smaller banks in particular resolve problem loans. For example, centralizing impaired assets from several banks into an AMC may help reduce the fixed cost of asset resolution, increase the efficiency of asset recovery, and allow for a more efficient packaging of assets for sale to outside specialist investors. Second, and relatedly, AMCs are likely to enjoy greater bargaining power due to their size, especially when loans are scattered within the system, collateral is pledged to multiple creditors, and the size of debtors is large relative to that of banks. Third, they encourage specialization by enabling banks to focus on new lending while allowing the AMC to concentrate on the recovery of impaired assets. This division of labor becomes increasingly important if NPLs are at systemically high levels and for smaller banks, which lack workout expertise and resources. Fourth, increased specialization can facilitate better valuation and credit discipline. The transfer of NPLs entails a separation of the loan administration away from their credit officers, which could foster a more objective assessment of credit quality. Finally, all these points together suggest that AMCs could be crucial to price discovery. Economies of scale, central bargaining power, and better valuation are likely to be key to solving the problem of collective inaction, thereby bridging the pricing gap in situations where no market exists, or the market is extremely illiquid.

- AMCs could be private or public. Larger banks may be in a better position to establish their own private AMCs. However, for smaller banks or in cases of market failure due to significant structural constraints or where NPLs have reached systemically high levels, consideration could be given to a national-level AMC with public participation. In either case, AMCs should be (1) complementary to other NPL resolution strategies (such as loan workouts in separate bank unit or bank-specific AMCs); and (2) combined with strict supervisory policies, robust insolvency frameworks, and the removal of obstacles to NPL resolution as described in the previous sections. Good governance and transparency are crucial to the success of AMCs. In cases of public participation, it would be necessary to ensure that the AMC operates as an independent entity and has a clear mandate to maximize the recovery value of assets. For instance, an AMC should not be set up as a unit within a central bank or a subsidiary thereof.

d. Support measures

The three-pillared strategy described above should be underpinned by support measures that cut across pillars, such as improving access to information and reforming tax regimes.

- – Improve access to debtor information to enhance the effectiveness of NPL workouts. Credit bureaus should include full details of borrowers’ debts above a specific threshold, including arrears to utility companies or tax authorities. Asset registers that record real estate, vehicle, machinery and equipment ownership should contain sufficiently granular information to facilitate reliable wealth assessments. Authorities should also ensure that such repositories are centralized, electronic, accessible to private sector agents, and economical. Improved links between asset registers and credit bureaus across national borders are needed in some regions to fully capture wealth and debt abroad.

- Deploy debt advisory services so debtors are well informed and confident to engage with creditors. Households should have access to free or subsidized budgeting and legal advice services to ensure they are aware of their options and are comfortable discussing them with creditors. These services should be complemented by coordinated public outreach campaigns including through availability of standard advice pamphlets at bank branches and creation of a citizens’ advice website dedicated to household debt management. Micro and small enterprises should have access to institutes of credit management to ensure sufficient understanding of debt and supply chain credit management. Implementation of such services for both households and small businesses would greatly benefit from the establishment of a qualification or profession for debt counselors.

- Reform tax rules to encourage NPL resolution. The credit hierarchy that applies to secured and unsecured private creditors and public authorities should be modified as necessary to ensure that all creditors are broadly and equally incentivized to support debt restructuring as well as enforcement and liquidation options. Tax rules should be reviewed and amended in areas where creditors are discouraged from provisioning or writing off loans or from selling any underlying collateral. Tax rules that inhibit debtors from accepting debt restructuring or write-off deals should also be amended.

- Conclusion

Reducing the level of impaired assets is essential for restoring the health of the banking sector and supporting credit growth in Ghana. High NPLs hold back credit supply by locking up capital that could be used to support fresh lending. And low write-off rates hinder necessary corporate restructuring and prolong the debt overhang, depressing credit demand. Given that impediments to NPL resolution are often interlinked, a comprehensive strategy is needed to address the NPL problem. Based on international experience, such a strategy should be based on three key pillars: (1) enhanced supervision, (2) insolvency reforms, and (3) the development of a distressed debt market.

References

1.Bank of Ghana- Financial Stability Reports and Banking Sector Reports

https://www.bog.gov.gh/privatecontent/MPC_Press_Releases/Banking%20Sector%20Report%20%20-%20July%202017.pdf

2.Ghana statistical service- Provisional Annual GDP(2016) April 2017 Edition

http://www.statsghana.gov.gh/gdp_bulletin.html

3.Strategy for resolving Europe’s Problem loans- https://www.imf.org/external/pubs/ft/sdn/2015/sdn1519.pdf

4.Non-performing loans in the Banking Union: stocktaking and challenges

http://www.europarl.europa.eu/RegData/etudes/BRIE/2016/574400/IPOL_BRI(2016)574400_EN.pdf

5..Two Approaches to Resolving Nonperforming Assets During Financial Crises

https://www.imf.org/external/pubs/ft/wp/2000/wp0033.pdf

6.Maximising Value of Non-Performing Assets

https://www.oecd.org/daf/ca/corporategovernanceprinciples/33962292.pdf

7.Tough love for bad debt? RBI deputy targets Indian banks’ toxic loans

http://www.reuters.com/article/us-india-cenbank-deputy-idUKKBN1682U6

http://www.reuters.com/article/us-india-cenbank-deputy-factbox-idUKKBN1682UK

8.Basel Committee on Banking Supervision (BCBS) guidance on the prudential treatment of problem assets – definitions of non-performing exposures (NPEs) and forbearance

http://www.bis.org/bcbs/publ/d403.pdf

–

By: Emmanuel Akrong