The Association of Ghana Industries (AGI) has raised concerns over the increase of the Bank of Ghana’s monetary policy rate.

The association fears the increase will have a negative impact on lending rates in the country.

According to AGI, its findings over the period have revealed that the prime rate has not improved lending to consumers.

The Monetary Policy Committee (MPC) of the Bank of Ghana (BoG) on Wednesday increased the monetary policy rate by 200

basis point from 19 percent to 21 percent, as part of moves to tame inflation, which is currently at 16.9 percent.

The AGI says even though the capital reserve requirement for commercial banks has been reduced from 11 percent to 10

percent it does not really translate into a decline in the base lending rates.

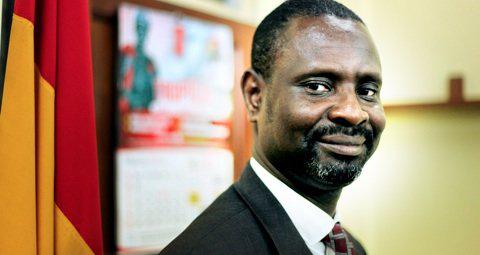

Speaking to Citi Business News President of AGI James Asare Agyei said BOG will have to do more to ensure commercial banks

do not pass on the increase to consumers.

“What AGI will want to ask is that the Bank of Ghana puts in mechanisms to ensure that the commercial banks do not pass

on the increase in the prime rate to lenders.”

According to him ‘over years a lot more people are not able to draw any sought of relationship between prime rate, lending

rate, inflation and other macroeconomic indicators and in most cases when prime rate goes up banks are quick in adjusting

their lending rate. However when prime rate is decreased or comes down we don’t see that corresponding hurriedness in

ensuring that interest rate comes down’.

“These are things that need to be addressed and I think that as a country if we want to see our industry grow, if we want

to see our manufacturing sector which could be the largest employing unit thrive, then definitely there should be some

mechanism or some process of the supervising Bank (BOG) ensuring that the commercial banks don’t have a field day, but are

supporting the productive sectors of our economy.”

By: Norvan Acquah – Hayford/citifmonline.com/Ghana